philadelphia wage tax for non residents

On the other hand if a Philadelphia employer requires a non-resident to perform duties outside the city he or she is exempt from the Wage Tax for the days spent fulfilling that work. The Philadelphia Net Profits Tax NPT which is imposed on the net profits from the operations of a trade business profession enterprise of other activity.

Philadelphia Wage And Earnings Taxes Decrease On July 1 Department Of Revenue City Of Philadelphia

The City Wage Tax for Philadelphia residents is 38712 and 35019 for non-residents.

. The City of Philadelphia announced that effective July 1 2020 the Wage Tax rate for nonresidents is 35019 an increase from the previous rate of 34481. All Philadelphia residents owe the City Wage Tax regardless of where they work. Catfish Restaurants In Grove Ok.

The City of Philadelphia announced that effective July 1 2021 the Earnings Tax rate for nonresidents is 34481 down from 35019 and the rate for residents is 38398 a decrease from the previous rate of 38712. February 13 2022. Nonresident employees who mistakenly had wage tax withheld during the time they were required to perform their duties from home.

A non-resident employee who works from home for his or her convenience is not exempt from the Wage Tax even with his or her employers authorization. The rate for residents remains unchanged at 38712. The refund is allowable only for periods during which a non-resident employee was required to work outside of Philadelphia either pursuant to City ordinance or employer policy.

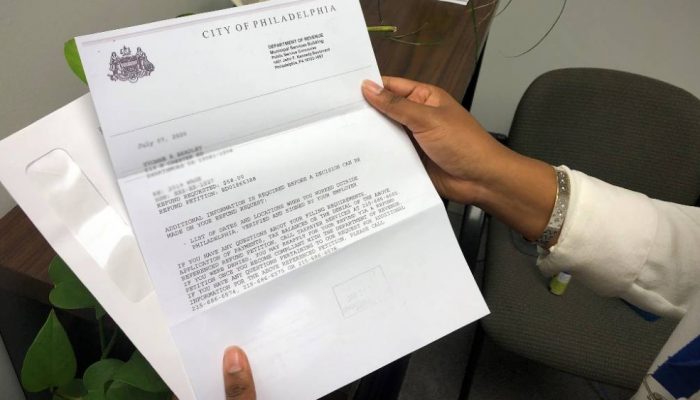

The City requires an employer to withhold. The Philadelphia Department of Revenue is providing 2020 City Wage Tax refunds to non-city residents required to work from home due to the pandemic. These are the main income taxes.

Mandarin Chinese Restaurant Lahore. News release City of Philadelphia June 30 2020 Similarly the Philadelphia nonresident Earnings Tax and Net Profits Tax NPT. On May 4 2020 the Philadelphia Department of Revenue updated its guidance for withholding the Wage Tax from nonresident employees who are working in the city temporarily due to COVID-19.

The deadline is weekly monthly semi-monthly or quarterly depending on the amount of Wage Tax you withhold. City of Philadelphia Wage Tax This is a tax on salaries wages and other compensation. The city of Philadelphia increased its wage tax rate for nonresidents to 35019 from 34481 effective July 1 2020 the citys revenue department said on its website.

Employees will need to provide a copy of their W-2. Non-residents who work in Philadelphia must also pay the Wage Tax. Nonresidents who work in Philadelphia pay a local income tax of 350 which is 043 lower than the local income tax paid by residents.

Non-resident employees who had Wage Tax withheld during the time they were required to perform their duties from home in 2020 may file for a refund with a Wage. Only non-resident employees are eligible for a Wage Tax refund for work performed outside of Philadelphia. The current wage tax rate in the city is 34481 percent.

Effective July 1 2021 the rate for residents is 38398 percent and the rate for non-residents is 34481 percent. Philadelphia Wage Tax For Non Residents. Nonresident employees who mistakenly had Wage Tax withheld during the time they were required to perform their duties from home in 2020 will have the opportunity to file for a refund with a Wage Tax reconciliation form in 2021.

Non-resident employees who had City Wage Tax withheld during the time they were required to perform their duties from home in 2020 may file for a refund with an online Wage Tax refund petition in 2021. On the other hand if a Philadelphia employer requires a non-resident to perform duties outside the city he or she is exempt from the Wage Tax for the days spent fulfilling that work. Residents of Philadelphia pay a flat city income tax of 393 on earned income in addition to the Pennsylvania income tax and the Federal income tax.

The new wage tax rate for non-residents of Philadelphia who are subject to the Philadelphia municipal wage tax is 35019 percent which is an increase from the previous rate of 35019 percent 035019. Tax rate for nonresidents who work in Philadelphia. Therefore the wages of employees who are working remotely outside the City of Philadelphia are not applicable to City Wage Tax.

City residents have to pay 38712 and non-residents who work in the city owe 35019 2020 tax year. Employees file for a refunds after the end of the tax year and will need to provide a copy of their W-2 form. Effective April 1 2020 for employees paid monthly and March 28 2020 for employees paid biweekly the Philadelphia Non-Resident Wage Tax payroll deduction will be turned off for the applicable employee population.

Normally Philadelphia non-residents employed in the city can get a wage tax. PHILADELPHIA WPVI -- So many people are working from home during the pandemic and that could impact your taxes. Paychecks issued by employers that operate in the city must apply the new tax rate to all wage payments issued to nonresident employees with a pay date after June 30 2020.

Sales Tax Reno Nv 2021. Effective January 1 2014 all employee Wage Tax refund petitions require documentation to verify any time worked outside of. See EY Tax Alert 2020-0751In the updated guidelines the Department states that an employer may continue to withhold the.

Non-resident employees who had Wage Tax withheld during the time they were required to perform their duties from home in 2020 can file for a refund with a Wage Tax reconciliation form in 2021. For more information about the City of Philadelphia Wage Tax go here. In the state of California the new Wage Tax rate is 38398 percent.

What is the Philadelphia city Wage Tax for residents. The new rates are as follows. Resident employees are taxable whether working in or out of Philadelphia.

The previous guidance was published on March 262020. Beginning on July 1 2021 the City of Philadelphia will lower the rates of its Wage Tax and Earnings Tax for both resident and non-resident taxpayers alike.

Philly Wage Tax To Be Lowered In New City Proposal Whyy

When Are Non Residents Exempt From Philadelphia S Wage Tax Department Of Revenue City Of Philadelphia

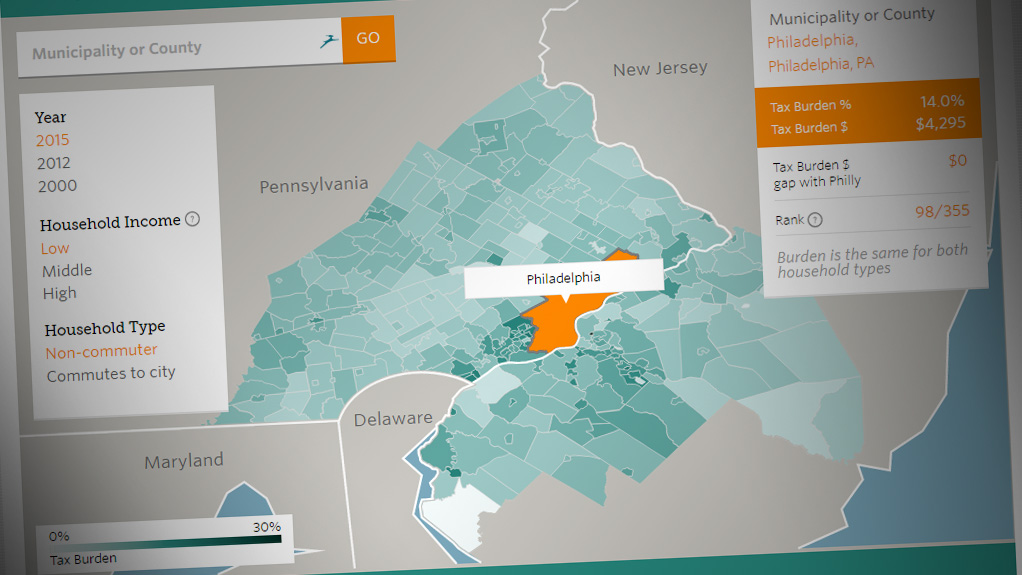

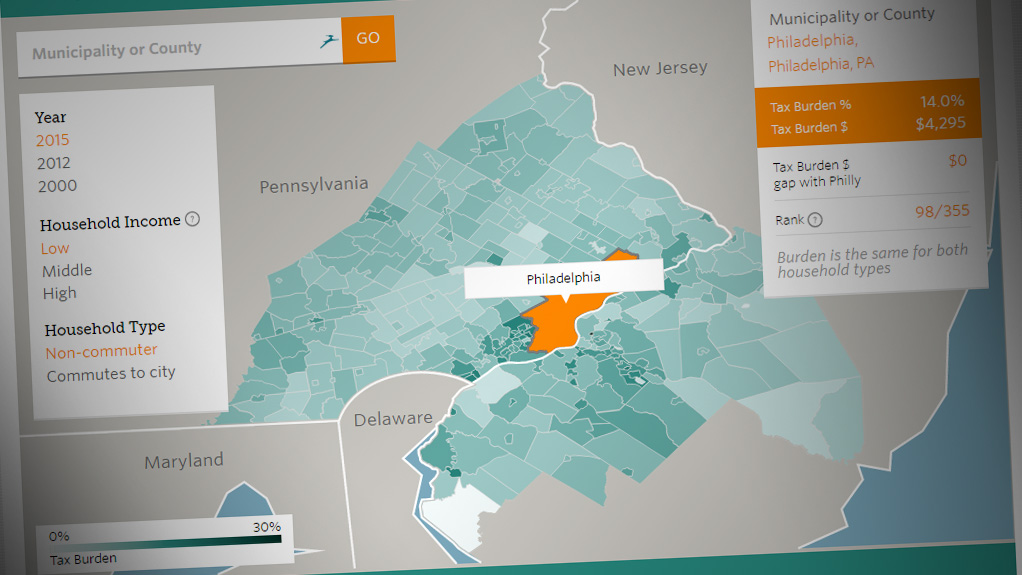

Comparing The Tax Burden In Philadelphia And The Suburbs The Pew Charitable Trusts

![]()

Philadelphia Wage Tax Refunds Reboot For 2021

Phillydotcom Infographic Infographic Gambling Information Graphics

Who Is Entitled To A Wage Tax Refund Department Of Revenue City Of Philadelphia

Over 42 000 Philadelphians Use New Online Tax System On Top Of Philly News

Hourly Wage Then Log Download Pay Stub Template Word Free With Regard To Pay Stub Template Word Document Cumed O Word Free Templates Microsoft Word Templates

You Pay Lots Of Philly Taxes But Do You Know Why Philadelphia Magazine

Philadelphia Wage Tax Decreases On July 1 Department Of Revenue City Of Philadelphia

Pennsylvania Rules On Philly Wage Tax Credit Case Grant Thornton

Wealth Tax Proposed In Philadelphia With Support From Sen Elizabeth Warren Philadelphia Business Journal

Philly Wage Tax To Be Lowered In New City Proposal Whyy

Philly Councilmembers Unveil Proposal To Tax Philly S Ultra Rich

City Of Philadelphia Announces Wage Tax Rate Increase For Non Residents Starting July 1 2020 Wouch Maloney Cpas Business Advisors

Philadelphians Who Work Outside Pa Could Be Eligible For Wage Tax Break Whyy

Philadelphia Looks To Reduce City Wage Tax To Offset Rising Property Tax Burden Philadelphia Business Journal

Why Was My Refund Request Denied Answers To Frequent Wage Tax Questions Department Of Revenue City Of Philadelphia

/cloudfront-us-east-1.images.arcpublishing.com/pmn/JJVOE3MU7BD5XHJ3LOWCOOJTVU.jpg)

Philadelphia Refunds Millions In Wage Taxes To Suburban Commuters