new mexico solar tax credit 2020 form

Lets say you install an 18000 solar panel system on your home. The balance of any refundable credits after paying all taxes due is refunded to you.

What Is A Ucc 1 Filing For Solar Panels

Why Should You Go Solar.

. New Mexico state solar tax credit. For assistance see the New Solar Market Development Income Tax rule 3314 NMAC for personal income taxes or 3421 NMAC for corporate income taxes and other information available at the Clean Energy. For property owners in New Mexico perhaps the best state solar incentive is the states solar tax credit.

The New Solar Market Development Income Tax Credit was passed by the 2020 New Mexico Legislature. The new solar market development tax credit may be claimed by a taxpayer who files a New Mexico personal or fiduciary income tax return for a tax year beginning on or after January 1 2020 and has purchased and installed a qualified photovoltaic. The residential ITC drops to 22 in 2023 and ends in 2024.

After it expired in 2016 New Mexicos governor Michelle Lujan Grisham signed the New Solar Market Development Tax. The federal solar tax credit. 7 Average-sized 5-kilowatt kW system cost in New Mexico.

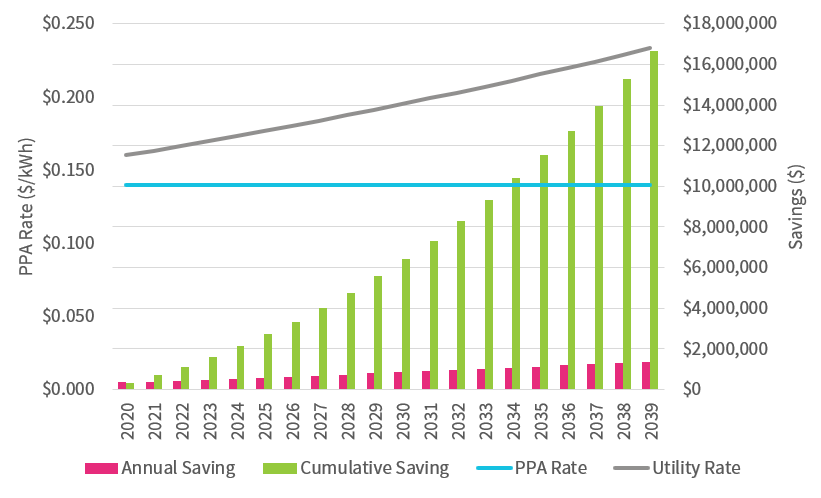

The PIT-RC Rebate and Credit Schedule is a separate schedule to claim refundable credits. Youll find this credit in Business Credits within the New Mexico portion of TurboTax. You will then file for the tax credit with your tax return before April the following year using the Form 5695.

Your state tax credit would be equal. Buy and install new solar panels in New Mexico in 2021 with or without a home battery and qualify for the 26 federal solar tax credit. This incentive can reduce your state tax payments by up to 6000 or 10 off your total solar energy expenses whichever is lower.

But the new solar tax credit really pushes your savings over the top making solar an even better investment than it was in the past. 09132016 To complete Section II of the claim Form RPD-41227 Renewable Energy Production Tax Credit Claim Form attach a com - pleted Schedule A to compute unused credits for carry forward from prior tax year claims. The wait is over.

So the ITC will be 26 in 2020 and 22 in 2021. Obviously there are many incentives to go solar such as the benefits provided by the New Mexico solar tax credit but truly solar can be viewed as an. The solar market development tax credit may be claimed by a taxpayer who files a New Mexico personal or fiduciary income tax return for a tax year beginning on or after January 1 2006 and has purchased and installed a qualified photovoltaic or a solar thermal system after January 1 2006 but before December 31 2016 in a residence business.

See form PIT-RC Rebate and Credit Schedule. The Residential Solar Investment Tax Credit ITC for the total cost of solar installation goes until 2019 at 30. The credit is capped at 6000.

The solar market development tax credit may be deducted only from the taxpayers New Mexico personal or fiduciary income tax liability. New Mexicos popular solar tax credit scheme that previously aided about 7000 residents is brought into action again. It is taken in the tax year that you complete your solar install.

12790 Approximate system cost in NM after the 26 ITC in 2021. Each year after it will decrease at a rate of 4 per year. The tax credit applies to residential commercial and agricultural installations.

The starting date for this tax credit is March 1 2020 and the tax credit runs through December 31 2027. It provides a 10 tax credit with a value up to. Click New Solar Market Development Continue Enter up to three credit certificates and the amount of credit applied to tax.

SOLAR MARKET DEVELOPMENT TAX CREDIT CLAIM FORM Enter the credit claimed on the tax credit schedule PIT-CR or FID-CR for the personal income tax return Form PIT-1 or the fiduciary income tax return Form FID-1. The tax credit is up to 10 of the purchase and installation of the solar panels. Upload Application Please review the above list before you upload your documentation to make sure youve completed all forms required in the tax credit application package.

The Solar Market Development Tax Credit provides a tax credit of 10 for small solar systems including on-grid and off-grid PV systems and solar thermal systems. New Mexico provides a number of tax credits and rebates for New Mexico individual income tax filers. The credit is applicable for up to 8 years starting in 2020.

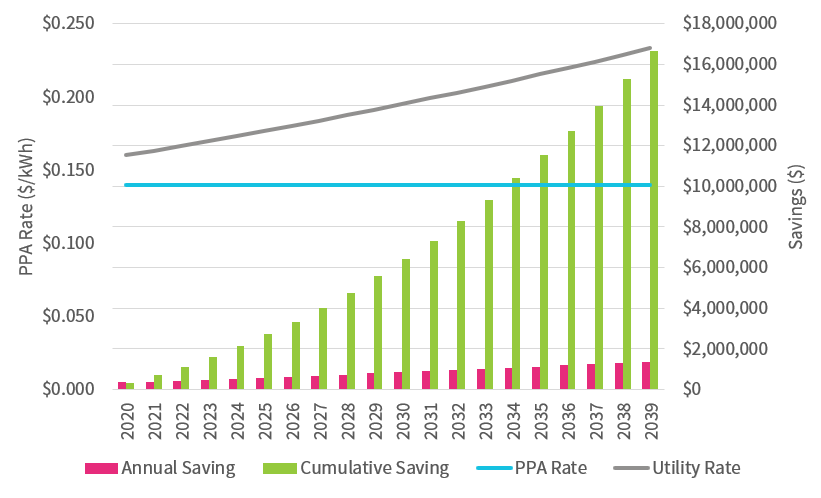

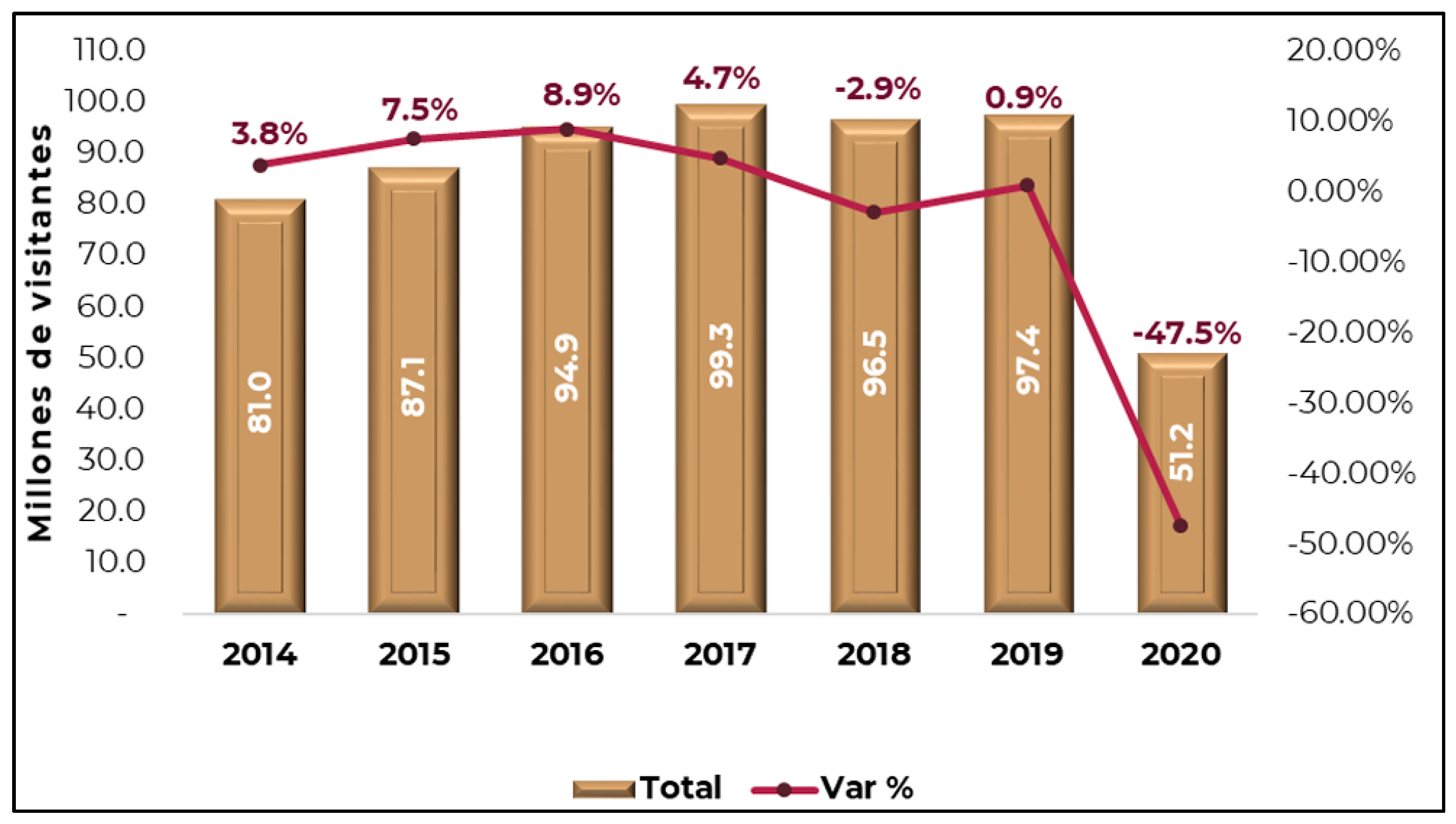

Even before the return of the state tax credit switching to solar in New Mexico would bring you substantial savings on your electric bill.

Time S Running Out Why Public Institutions Should Act Quickly To Maximize Solar Tax Credits Forefront Power

How To Calculate The Federal Solar Investment Tax Credit Duke Energy Sustainable Solutions

Solar Panel Installation Guide How To Go Solar 2022 Saveonenergy

Time S Running Out Why Public Institutions Should Act Quickly To Maximize Solar Tax Credits Forefront Power

2020 New Mexico Primary State Senate Endorsements Rio Grande Chapter

New Mexico Solar Incentives Rebates And Tax Credits

New Mexico Solar Incentives Rebates And Tax Credits

Why Energy Companies Are Drilling For A Greenhouse Gas In New Mexico The Nm Political Report

Electric Hybrid Car Tax Credits 2022 Simple Guide Find The Best Car Price

What Is A Mortgage Credit Certificate Mcc And Are They Worth It

Understanding The Utah Solar Tax Credit Ion Solar

Understanding The Utah Solar Tax Credit Ion Solar

Understanding The Utah Solar Tax Credit Ion Solar

2020 New Mexico Primary State Senate Endorsements Rio Grande Chapter

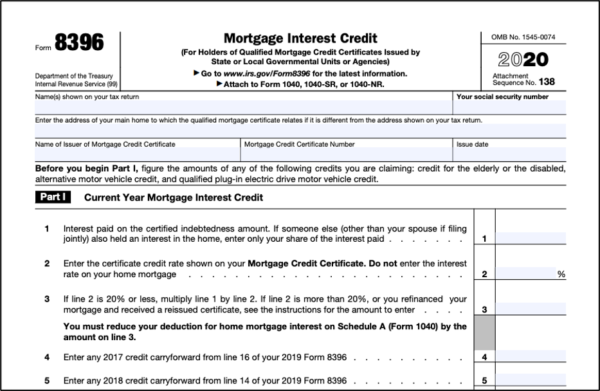

Sustainability Free Full Text Impact Of The 4 Helix Model On The Sustainability Of Tourism Social Entrepreneurships In Jalisco And Nayarit Mexico Html